Office Building and Units

|

|

|

Mold contamination in a new high rise office building.

Two separate HVAC system components in two separate units failed causing water to flow down 5 floors.

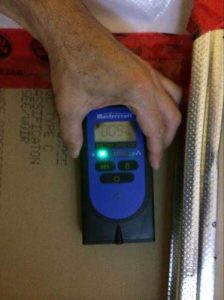

The building had 85% occupancy when surface mold growth was starting to become visible in the building common hallway areas. The investigation was completed using infrared technology and non-intrusive moisture detectors to evaluate common hallways and units for mold growth and water intrusion in the non-visible areas such as the wall cavities, ceilings and furnishings.

When water leaks occurs from any water system the water is categorized as category 1 or 2 or 3 depending the amount of time it takes to dry the property and/or where the water is coming from. It requires different types of Remediation. Drying the property is of most importance in order to avoid further damage to the landlord and tenant alike.

Breaking News

The Office Buildings claims are similar to property claims of Condo-Hotels, Hotels/Motels, Commercial and Residential Condo Associations, Multi-family-Apartment buildings. One of the main differences to these claims would be the tenancy occupying these properties.

These properties are occupied by tenants in business. There are contributing factors that make each of these types of insurance unique, but as a whole they are insured with Commercial Package Policy (CPP) and endorsements or Business Owners Policy (BOP) tailored to each of their unique circumstances and business risks.

Given the recent economic impact with our global and local economy, Commercial office space has more vacancies now than when the Real Estate bubble was on full force.

Some of these businesses experienced economic losses and have fallen victims of the economic challenges. We recognize these circumstances and are prepared to work closely with the owners and /or their management team to ensure adequate insurance claim settlements to them. In some cases the properties are in the process or have been foreclosed, we will work also closely with lenders, asset managers, and court appointed receivers to meet the insurance claims needs

HomeOwner Claims Public Adjusters value and understand the owner’s / landlord’s position as well as the tenants when property damage occurs to the building. The Landlord has the responsibility to make the necessary repairs to the building as well as making sure that the building damage does not affect the tenants. Subsequent to a loss in the building most likely the tenant(s) is also affected.

Most tenants have business insurance policy to protect their property and the business interruption due to a peril insured against as it is a requirement on their lease. They also have to insured for improvements and alterations (betterments) to the rented space to protect the landlord’s property. We adjust the Landlord’s Commercial Package Policy (CPP) or Business Owners Policy (BOP) which includes but is not limited to; Property Damage (Building), the Business Personal Property, Debris Removal Coverage, Co-Insurance (link to Co-Insurance page) and Deductibles, Ordinance or Law Coverage, Signs Coverage, as well as the loss of Business Income and/or Extra Expense and the Fair Rental Value while being unoccupied due to the loss. Your Insurance Agent tailors your insurance policy according to your Risk.

These types of policies are very intricate and require attention to detail when adjusting such unique risks. We encourage every policy holder to engage our services due to the complexities of these unique risks.

Your time is valuable; filing an insurance claim has many challenges and is not as simple as it should be. This is a job for a professional Public Insurance Adjuster such as HomeOwner Claims Public Adjusters.

Filing an insurance claim is tedious, difficult to understand the insurance policy and forms, is intricate, complex and time consuming. It is a greater challenge when it involves the many tenants that you rent the property to. The Landlord must protect itself, the tenant’s wellbeing and their property.

Ask yourself these questions: Can you give up your time? Can you keep records of the loss? Do you know what the insurance policy covers? Can you take the chance to be wrong? Can you afford controversy with the tenant? It’s been proven that an unbiased third party would bring better results to the table. Your claim can be prejudiced if improperly presented.

What will you say to the tenants that rely on you to make the right decision and protect their best interest? While you protect their interest you are also protecting yours. Remember that as a Landlord you must protect the tenant’s interest and your property.

We settle more and quicker insurance claims because of our long standing relationships within the industry proven by our track record of performance in dealing with both the insurance companies, who provide the coverage, and the policyholders “our clients” in which we service. This means that you have a dedicated insurance public adjuster who has worked in all 3 capacities of adjuster (link to 3 types of adjusters) since 1979 by your side with the experience, knowledge; we speak insurance language and competency to make sure we settle your claim fairly to restore your property to pre-loss condition or better.

Read the Office of Program Policy Analysis & Government Accountability report (link to OPPAGA Report) their analysis stated that when the policyholders engaged a Public Adjuster the settlement amounts were higher by 547% on daily claims and 747% on hurricane claims). We strongly believe that HomeOwner Claims Public Adjusters has earned their reputation and continues to raise the standards of Commercial and Residential properties insurance claim services.

We strongly believe that HomeOwner Claims Public Adjusters has earned their reputation and continues to raise the standards of commercial and residential properties insurance claim services.